October 2017 was when I first got interested in Bitcoin. During this time it seemed like most news outlets were covering it.

Everybody from hedge fund heavyweight Mike Novogratz, venture capitalist Tim Draper to online personality and security expert John Mcafee were giving wild projections of what Bitcoin price would be in a few years.

Of course, without thinking twice, I jumped right in. FOMO in as they say, and invested a few thousand dollars immediately.

As weeks go by I put in more and more money, totaling close to $360,000, all before February of 2019. The market run-up was swift and quickly shot my portfolio past $500,000.

I recall telling my wife that it was the easiest money I have ever made and at the same time I told her that this didn’t feel right because it just seemed too easy. There was no way this was sustainable.

Shortly soon after I found this to be true.

Where Did I Get The Funds To Invest?

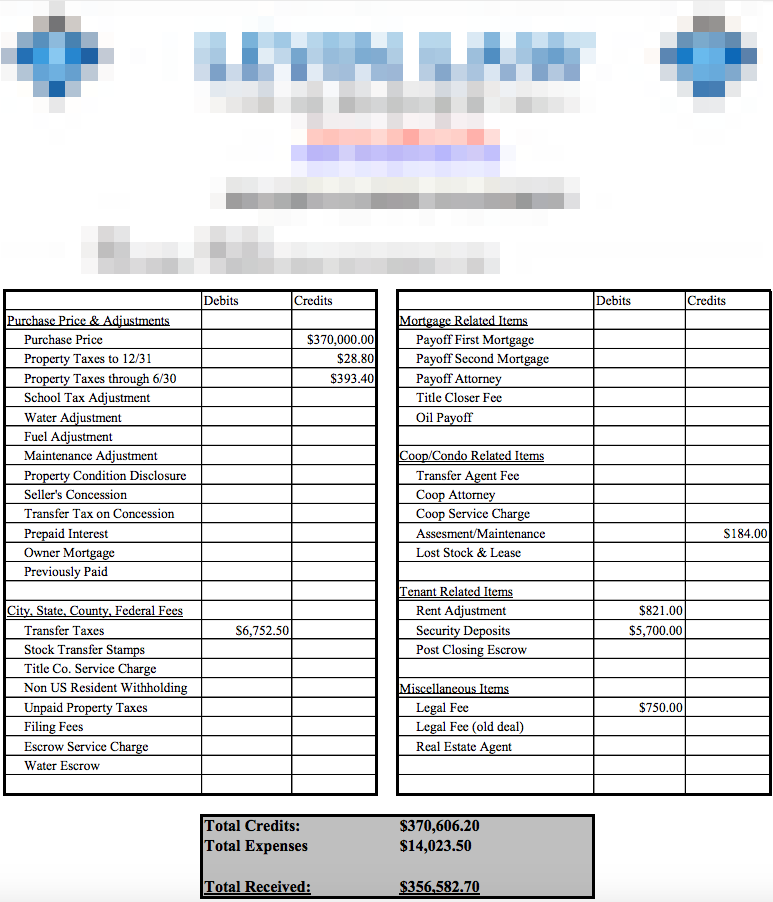

I sold a property in December of 2017 and was able to cash out roughly $356,000.

At that time my decision was to either roll over the net proceeds to a new property in the form of a 1031 Exchange or invest the funds in an emerging asset class that I keep on hearing about, cryptos.

As you probably already tell I decided to invest in the latter.

Before I know it I already invested tens of thousands of dollars in buying cryptocurrencies and bought Bitcoin when it was at $18,500, $19,000, $19,500, etc., buying it as it continues to climb higher.

I looked at my portfolio everyday like clockwork and saw that the return was phenomenal. In the span of 1.5 months I have made 6 figures.

I remember thinking that I have found my calling and I would be a full-time investor. Without much hesitation I poured more money into the market until I had committed most of the funds from the sale of the property.

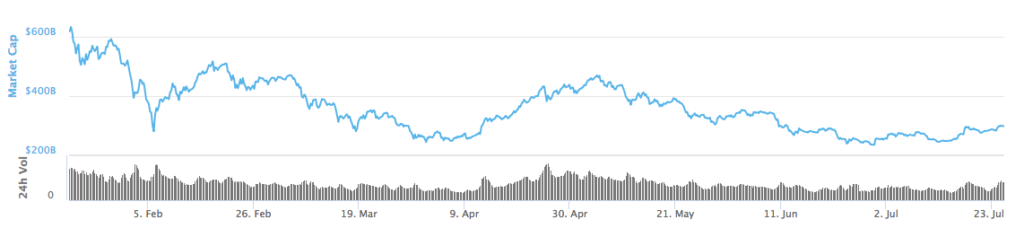

Market Turns Bearish

The market entered the crypto winter in early 2018 and along with it my portfolio took a nosedive. It wasn’t sudden but it was a slow and painful one.

I held to the glimmer of hope that the drop in prices was temporary and it would eventually find its way back up and we’ll all be posting moon landing memes again.

The market during the middle of the year went sideways for awhile and stayed that way while Bitcoin was consolidating in the mid to upper $6,000’s.

Then towards November and through December Bitcoin prices dropped to below $4,000.

As of the date of this writing Bitcoin price stands at $3,580 a complete collapse from the peak of January of the previous year.

My portfolio at its lowest point was just around $20,000, this from a peak of $540,000.

Needless to say I have learned many lessons. I share them in hopes that that you don’t make these same mistakes.

Crypto Addiction Is Bad

Emotionally it was a roller-coaster, with short-term euphoria when prices went up and disappointment when prices dropped.

I was literally on CoinMarketCap, hitting the refresh button to see the updated prices every minute.

It was really time consuming and I caught myself checking the page first thing in the morning and right before I went to bed, and hundred of times throughout the day.

It was an addiction.

I knew my bad habits had to change.

I would advise my former self the following:

- If it ever gets to a point when every waking moment you are thinking about crypto and it is affecting your emotions then is best to step away and get your mind off the subject for awhile.

- Put down your phone every time you catch yourself looking at CMC for more than once an hour.

- Do something more productive with your time, like learn a new skill or go to the gym and put a sweat on.

- Everybody needs time to rejuvenate and reenergize and you’re no different.

Invest and Not Gamble

I thought I was investing but it was more like gambling. I put in good money to chase after bad, splashing fiat(“real money”) on a crypto(“fake money”) without knowing anything about it.

I rationalize that it must be a good buy since it had pumped recently. This became a repetitive behavior, and I even increased my bet size on new projects.

Actual investing requires due diligence, reading the Whitepaper and learning what makes the particular project stand-out in the already saturated cryptocurrency space.

But, you say, all Cryptos went to Sh*t. This is true but I had bought into some projects that literally lost 99%+ of its ICO value. If this isn’t gambling, I don’t know what is.

After all, it is better to skip an investment than invest in something that you are not completely sure about.

As Warren Buffet puts it,” you don’t have to swing at every pitch. The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot.”

So study, really learn, the project and everything about it before contributing a single BTC or ETH.

Use House Money

One thing that I should have done, and regret not doing, is to invest with the profits instead of leaving my entire investment in.

If I had just liquidated a portion of my portfolio when I was up I would have been able to invest with only the house money.

This would have been a major lift to my mind, body, and soul knowing that I would just be putting the gains at risk.

Instead the huge crash raised my stress level, affected my mood and well being, and eradicated the funds in my account. It caused me a property at the end.

Liquidation is key, sell when you are up. You don’t have to sell everything at once, do it in stages but I prefer selling and taking profits rather than HODLing in a bear market.

Don’t FOMO Instead FOLA

I think this is one of the worst things that can happen to you when you are investing in crypto. When most coins were going up in the bull market of 2017 you hear and read about how much people were making.

Those that invested early in the year or prior years saw their investment go up 2-5x.

The feeling of not wanting to be left behind is so strong that I quickly got sucked into buying a lot of crappy coins just to make a quick buck.

Turn your FOMO into FOLA, instead of the Fear Of Missing Out, you should invest like you have the Fear Of Losing All.

If the fear of losing money is greater than missing an opportunity then your investing strategy will prioritize preserving and growing your capital as opposed to possibly putting your entire portfolio at risk.

Tread carefully, it will save your pocket in the long run.

Don’t Buy The Dip

You hear all these advices on Telegram and message boards about buying the dip but nobody can tell where prices will go eventually.

Unless you are a day trader and doing technical analysis is your specialty I don’t believe you should try and buy the dip or time the market, which is essentially what it is.

I saw myself buying the dip only to see it go lower still.

In a bear market a new bottom gets created every time support is broken to the downside.

This is why trying to buy the bottom is like trying to figure what Bitcoin price will be in a year from now, nobody knows for sure.

Rather than buying the dip I think a better strategy is to dollar cost average your purchases over weeks or months.

That way you are not trying to predict what the market is going to do, rather, you are minimizing your risks due to market volatility.

Don’t Invest More Than You Can Afford To Lose

This is one advice that most crypto traders talk a lot about but I believe it is also one of the hardest to follow.

You don’t know that you can’t afford to lose the money until it is gone.

Times were good when I started, my portfolio was seeing new ATH every week until it stopped.

Warren Buffet said that the first rule of investing is “never lose money.” Second rule of investing, “never forget rule number one.”

For me I didn’t understand it because when I first started I didn’t know anybody that invested in crypto and lost money.

You could have closed your eyes and put money into random projects and the price would eventually go up.

I didn’t think losing money was a possibility until reality hit and the market turned.

I could have better invested my funds in something that I already know well about, which is real estate. Instead I chose something that was new and exciting and fell into the shiny object syndrome.

Unless you understand the technology and know intimately the projects you are putting your hard earned money in I would caution you to stop and think twice before investing the funds.

I would go further and say that you should only invest with disposable cash, extra money you would use if you were to go to a casino.

If you have immediate need for the cash don’t put it into the market, satisfy all your financial obligations first.

Don’t Listen To The So-called Experts

I invested in many projects that were shilled by Youtube personalities. I figure since they have such a huge following they must know what they are doing.

Why else would so many people listen to what they have to say?

Many of these projects end up being duds.

Admittingly, some of the projects that I still believe strongly in today was first brought to my attention after following these people.

It is my research that ultimately gave me the reassurance and the confidence in these projects, not their paid shilling.

Crypto is new, nobody is truly an expert.

Considering Bitcoin came into existence only about 10 years ago you would probably know just as much as the next guy if you did some homework.

So never invest just because a Youtuber says so. Do it because you actually did your own research and came to that conclusion.

Learn as much about blockchain and cryptocurrency as you can so you will have the knowledge and conviction to know that an investment is worthy of your money when it comes along.

Technology Is Important

Price action is exciting but the technology is more important.

I didn’t understand the technology in the beginning and just invested along with what the crowd was doing.

It was shortsighted and not a strategy that would work long-term.

Technology plays a pivotal role in creating value, which will eventually lead to mass adoption in the near future.

Without understanding the science and fundamentals there is no way you will be confident enough to ride your investments through to the very end, where the vast majority of the reward is reaped.

Everybody’s dream of moon landing will become a reality only when the technology succeeds.

Final Thoughts

These were some of the tough lessons that I had to learn and I think at the end will make me a better investor and person.

I am grateful that even though I lost over half a million dollars I still have a roof over my head, no shortage of food to eat, good health, and a family that cares about me.

Lastly, I still believe in the promises of blockchain technology and, in particular, cryptocurrency.

However, what I would do differently now is to guard my money closely and not give it out as quickly and as willingly as before.

Money that took years to make only took months to lose in crypto.

Learn from my mistakes and I hope to see you on the moon someday!

Did you lose money during the bear market of 2018? What were some of the lessons you learned. Please let us know by commenting below.

Review Overview

- Content

Thank you for writing this article. I went through exactly the same thing you did and it is nice to know that I'm not alone!